- Thursday, April 18th, 2024

Scott on Housing in America: “The American Dream of homeownership is further out of reach today than it was just a few years ago.”

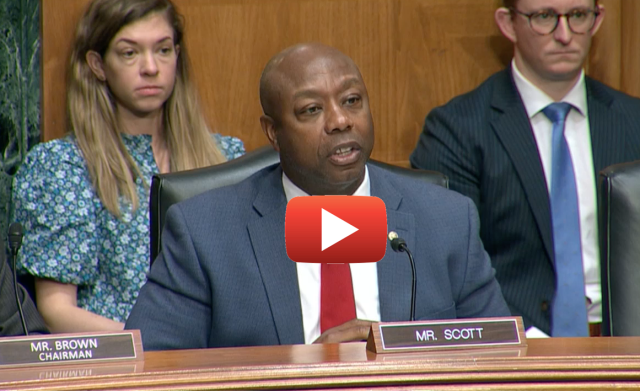

WASHINGTON — As too many Americans struggle to afford rent and mortgage payments, and as homelessness rates reach record-high levels, the U.S. Senate Committee on Banking, Housing, and Urban Affairs today held a long-overdue hearing with U.S. Department of Housing and Urban Development (HUD) Acting Secretary Adrianne Todman and Federal Housing Finance Agency (FHFA) Director Sandra L. Thompson. U.S. Senator Tim Scott (R-S.C.), Ranking Member of the Senate Banking Committee, has pushed for this hearing for over a year given the housing crisis facing families across the country.

During his opening statement, Senator Scott called out the Biden administration’s housing regulators for prioritizing excessive spending, burdensome regulations, and far-Left climate initiatives over commonsense reforms to failed federal housing policies. The Senator also urged the committee to consider his housing legislation, the ROAD to Housing Act, which takes a comprehensive view of federal housing policy and introduces needed reforms across all segments of the U.S. housing market that will increase housing supply, improve quality of life for families, and provide economic opportunity in communities across the nation. His bill would require annual testimony from the HUD Secretary and other officials administering government guaranteed or insured mortgage programs.

Watch Senator Scott’s opening statement here.

Senator Scott’s opening remarks as delivered:

Thank you, Mr. Chairman, and thank you both for being here – Acting Secretary – congratulations. 30 days, it’s a long time, so we expect you to be completely prepared for everything we’re going to talk about over the next couple of hours.

Thank you, Mr. Chairman, for holding this hearing.

I’ve been asking for about a year to have both of you in front of us so it’s certainly something that I think is absolutely essential for us to be able to hear from our regulators as often as possible to achieve the goal of American homeownership – because American homeownership is not just homeownership, it’s in fact, in the eyes of so many Americans, the American Dream.

If we’re going to close the wealth gap that we talk so much about – that is so persistent – one of the ways that you do that is by creating equity. And creating equity really comes from homeownership as much as it does any other place in our economy. So, thank you both for being here.

If you think about the value of homeownership, consistently Americans owe somewhere around a little bit more than $12 trillion on their mortgages, and mortgage debt accounts for about 70-plus percent of consumer debt in the United States of American. Not an insignificant amount of money.

And yet, the last time we had this hearing was back during the Trump years when Chairman Crapo was the chairman of this committee. I certainly hope we have more opportunities to hear from both of you at the same time going forward.

The American Dream of homeownership is further out of reach today than it was just a few years ago. Despite all the subsidies – all the trillions of dollars we’ve spent over the decades – little has changed.

In 1970, the homeownership rate in America was 64%. Today, it’s 65%.

Since the passage of the Fair Housing Act in 1968, that the goal was to eliminate housing discrimination, the homeownership rate for African Americans hasn’t changed much – 41% then, 44% today. It just continues to have a very slow growth trajectory.

Our housing regulators must testify more often so that we can find ways to deal with the challenges that housing presents to so many Americans.

Since President Biden has taken office: mortgage rates have ballooned by 150%; rents have gone up by about 20%; homelessness is up 12% in a single year, the highest number on record in the history of our country.

Despite empty promises from the White House about helping working families, the simple fact is that housing costs under this administration have skyrocketed.

I see that at home in South Carolina and, frankly, I see that across the nation as I travel.

I see that in families worried about how to make ends meet and watching the dream of homeownership slip further and further and further away.

What has become apparent is that this administration’s platitudes about affordability in housing have failed to line up with their policies.

Reckless spending on progressive wish lists fueled runaway inflation. And now Americans are painfully aware that Bidenomics has not helped them – instead burdening them so much.

The mountains of red tape and regulations this administration has put on housing providers are only making the matter so much worse.

Additionally, both HUD and FHFA have taken several politicized actions that will unnecessarily increase the costs for families and burden communities.

HUD recently imposed rent controls on Low-Income Housing Tax Credit properties. And FHFA is asking for public comments on policies, including rent control, following direction from the White House.

But what do these policies mean in practice?

They have the potential to limit the number of people served by these programs and restrict the supply of affordable housing.

Decades of research have proven that rent control policies make housing supply and affordability issues worse, not better, but this is the type of backwards logic Americans have come to expect from Joe Biden and Bidenomics.

Second, HUD unfortunately joined other federal agencies under this administration in attempting to add “climate regulator” to the list of the duties.

For instance, HUD proposed requiring that all newly constructed, subsidized housing be built to increased energy efficiency standards, even though HUD itself admits that lower-income households may not be able to afford the added burdens of additional costs.

According to the National Association of Home Builders, these new environmental mandates can cost as much as $31,000 to each new home.

So, at the same time a family is facing doubling and sometimes tripling food costs, in order to meet “green climate” goals, this administration saddles them with an extra $31,000 of additional expenses for a single home.

Families in communities like the one I grew up in can’t afford new climate costs that increases the costs of housing.

Which brings me to my last example. It appears this administration’s weak-on-crime policies have also been embraced by our housing regulators.

Last year, HUD proposed a rule encouraging cities applying for federal funds to remove “crime-free ordinances,” local laws that keep rental communities safe by keeping out convicted criminals.

Even worse, HUD proposed a rule last week that will make it easier for criminals to live in HUD subsidized housing, which risks making communities less safe.

We need to reverse course and take a different road when it comes to federal housing policy.

That’s why I announced housing as one of my top priorities for this year as the Ranking Member of this committee.

And since our very first housing hearing last April, I have focused my efforts on building consensus around the commonsense, nonpartisan reforms to all segments of our housing market included in my ROAD to Housing Act.

I continue to urge consideration of my ROAD to Housing Act, which takes a comprehensive view of federal housing policy and re-centers support around families, helping those who are homeless, or renting, or prepared to buy a house.

It is past time to consider my legislation, along with other commonsense bipartisan proposals that would include real solutions to tackle housing challenges.

I look forward to hearing from both of the witnesses today, and I look forward to having an eager conversation about some of the challenges that so many Americans face as it relates to building on their version of the American Dream.